Deriv is currently one of the largest online brokers in the world. Deriv offers CFDs and other instruments on forex, indices, cryptocurrencies, commodities and synthetics to millions of registered users globally.

General information

Deriv is an online trading platform that offers a variety of financial instruments for trading on its proprietary platform. With over 20 years of experience, it offers trading opportunities in CFDs and instruments on Forex, shares, indices, cryptocurrencies, options and commodities.

Headquartered in Malta, this broker is licensed and regulated by several financial authorities, including the Malta Financial Services Authority (MFSA), Labuan Financial Services Authority (LFSA), British Virgin Islands Financial Services Commission (BVI FSC) and Vanuatu Financial Services Authority (VFSC).

| Name | Deriv |

| Founded year | 1999 |

| Headquarters location | Tầng 3, W Business Centre, Triq Dun Karm Birkirkara, BKR9033 Malta |

| Official website | https://deriv.com |

| Contacting methods | – Live Chat – Through WhatsApp – Call phone number +44 1942 316229 – Email support@deriv.com |

| Trading products | 50+ Forex pairs, stock indices, composite indices, commodities |

| Trading tools | CFD, Forex, Binary Options |

| Minimum deposit | 5$ |

| Leverage | 1:30 | 1:1000 |

| Trading platforms | MetaTrader5 (Windows, macOS, Android, iOS), DTrader, Deriv X, Deriv EZ, Deriv GO, SmartTrader, DBot, Binary Bot |

| Fees | 2% of transactions per night |

Pros and cons

| Pros | Cons |

| • Diverse payment methods • Indicators are analyzed from systems and professional experts • Pay attention to the safety of the broker and customers • Trading platform suitable for all devices • Regularly supported and developed by the parent company • Safe and controlled by many organizations around the world • Trade and exchange commission-free with low transaction fees • 24/7 customer support | • Some countries do not have access to the broker • There are not many promotions • Does not provide trading copying tools |

Is Deriv a scam?

No, Deriv is not a scam. It is a trusted brokerage firm regulated by multiple entities that impose strict rules and guidelines on the broker's operations.

It is authorized and regulated by a number of financial authorities, including MFSA (Malta), LFSA (Malaysia), BVI FSC (British Virgin Islands) and VFSC (Vanuatu). This shows that the company complies with strict regulatory requirements and is closely monitored, which increases the safety and trust of traders.

Licenses

Deriv.com is licensed by the following authorities:

- Deriv (Europe) Limited is regulated by the Malta Financial Conduct Authority (MGA / B2C / 102/2000)

- Deriv (FX) Ltd is regulated by the Labuan Financial Services Authority (MB/18/0024)

- Deriv (BVI) Ltd is regulated by the British Virgin Islands Financial Services Comission (SIBA / L / 18/1114)

- Deriv (V) Ltd is regulated by the Vanuatu Financial Services Commission

- Deriv.com is regulated by the FSA Financial Commission

Security methods

As a regulated broker, its affiliation ensures the safety of client funds by separating them from the company's accounts and not using them for operational purposes. Additionally, the company offers negative balance protection to protect traders' accounts from negative balances during times of market volatility or unforeseen events.

Types of trading accounts

Demo Account

After confirming your email address, you will receive a demo account with a virtual balance of $10,000 (about 230,000,000 VND). This demo account allows you to trade on all markets offered by Deriv from SmartTrader or DMT5.

Real Account

To open a real account, you need to provide your personal information including name, address and phone number. The system will then ask you to select the base currency for your account, which can be fiat currency or cryptocurrency.

Fiat currency options include USD, GBP, EUR, and AUD, while crypto options include BTC, ETH, LTC, and USDT. After withdrawing your cash, you can use Smarttrader, DMT5 or DBot platforms to trade. You need to pay special attention to choosing the base currency for your account because you will be charged conversion fees when converting from one currency to another.

Leverage

The use of leverage in trading is one of the great opportunities to gain more exposure to the market with less capital, however it can also lead to significant profits or losses, depending on how leverage is used. trap. Therefore, it is important to have a good grasp of how leverage works and its potential effects before using it in trading operations.

Deriv leverage is provided according to MFSA, LFSA, BVI FSC and VFSC regulations, so each jurisdiction will be different:

- Traders are eligible to use the maximum rate up to 1:1000 for major currency pairs on international organizations.

- European clients are allowed to open accounts with Maltese institutions using the leverage up to 1:30.

Trading platforms

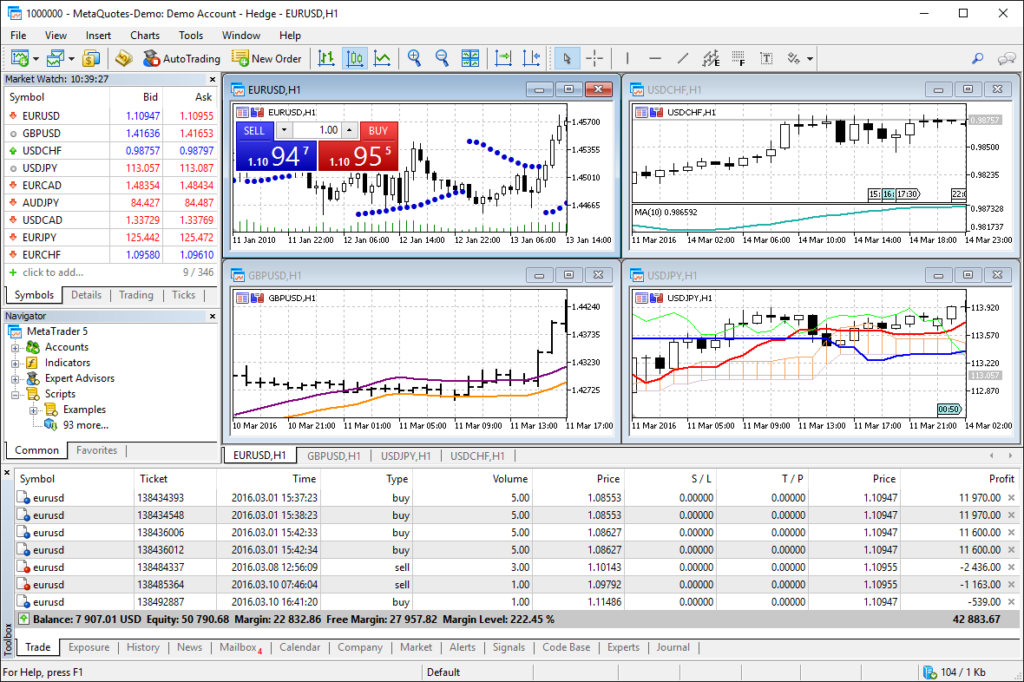

MetaTrader 5

MetaTrader 5 (MT5), developed by MetaQuotes Software, allows traders to access multiple asset classes – forex, stocks and commodities – on a single platform. The platform also integrates relevant research and analytics tools. MT5 is easy to use yet feature-rich, presenting a great combination for traders of all levels whether newbie or seasoned trader.

The platform can also be customized and traders can set up charts or trading areas as desired with multiple trading windows that can be opened at the same time or moved according to the user's needs. In addition, MT5 provides diverse trading assets, flexible leverage can be up to 1:1000, trading sizes also vary from micro lots to 30 standard lots.

SmartTrader

SmartTrader is a platform dedicated to binary options trading. This platform has a relatively different layout compared to the rest but the biggest difference is that you will be able to use much longer expiry times, up to 365 days.

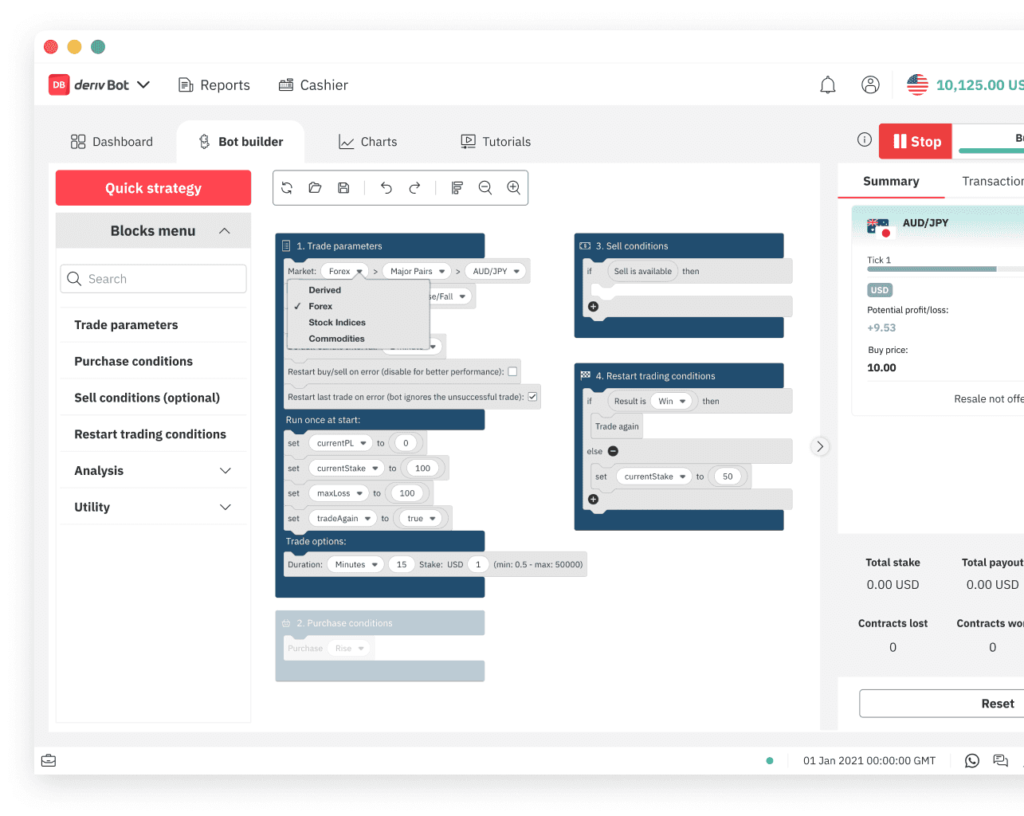

DBot

The system DBot of Deriv requires no programming. It is a technical generator for trading digital options available on the Internet. This system includes a BOT that automatically carries out transactions on your behalf.

Trading product types

Deriv provides a wide variety of trading instruments, such as CFDs, Forex derivatives, stocks, indices, cryptocurrencies and commodities. Traders can also access high leverage of up to 1:1000 for international institutional and Binary Options and Options trading, which has the potential to increase profits, however should be used with caution because this is a high-risk tool.

- Forex: Over 50 FX currency pairs, including majors, minors and exotics.

- Stock index: Speculate on price movements on the largest stock indices of the United States, Asia and Europe. You will profit from price movements across a major market or financial district without having to own the underlying asset. Originating from over-the-counter (OTC) markets, Deriv's stock indices offer competitively priced asset packages and allow you to trade even outside of major stock exchanges' business hours.

- Composite indexes: Based on a cryptographically secure random number generator audited for fairness by an independent third party. These indices are created to simulate real market movements and are not affected by natural events and disruptions. The composite index is available 24/7, has constant volatility, fixed period limits, and is not affected by market or liquidity risks.

- Commodities: Precious metals, such as gold and silver, are available, along with energy such as oil.

Trading types

1. Margin trading: Trading on the DMT5 platform, traders can take advantage of high leverage with low spreads, trade on all popular markets plus Deriv's exclusive synthetic indices, available 24/7. You can also open long and short positions, depending on your preferred trading strategy.

2. Options trading: Fixed, predictable payouts. You can trade the following options on Deriv:

- Numerical options allows you to predict the outcome from two possibilities and earn a fixed payout if your prediction is correct.

- Lookbacks allows you to earn a payout depending on the optimal high or low the market reaches during the contract period.

- Buying/Selling Spreads allows you to earn up to the specified payout depending on the position of the exit point relative to the two identified barriers.

3. Multiplier Trading: Combines the upside of leveraged trading with the limited risk of options. This means that when the market moves in your favor, you multiply your potential profits. If the market goes against your prediction, your loss is limited to the amount of your bet.

Fees

Deriv provides trading free of commission fees and free of deposit and withdrawal fees, making this a cost-effective option for traders.

Additionally, if a trader holds a position for more than a day, they will incur overnight fees. Brokers also incur 25 USD of inactivity fees for accounts that have been inactive for more than 12 months.

- Spreads and commissions: Deriv.com promises low spreads and minimal trading fees. Currently, Deriv's new system is still under construction, so spread and average commission data are limited. However, Binary.com has a reputation for competitive spreads and a transparent fee structure.

- Overnight fees: If you keep any positions open overnight, an interest adjustment (or overnight fee) will be charged to your trading account to compensate for the cost of keeping your position open. For Forex and commodities, the overnight fee is based on the interbank lending rate, in addition to a 2% fee charged daily (per night) to hold your position. Overnight fees also depend on the time and day that you keep your position open, and they may also be adjusted on public holidays.

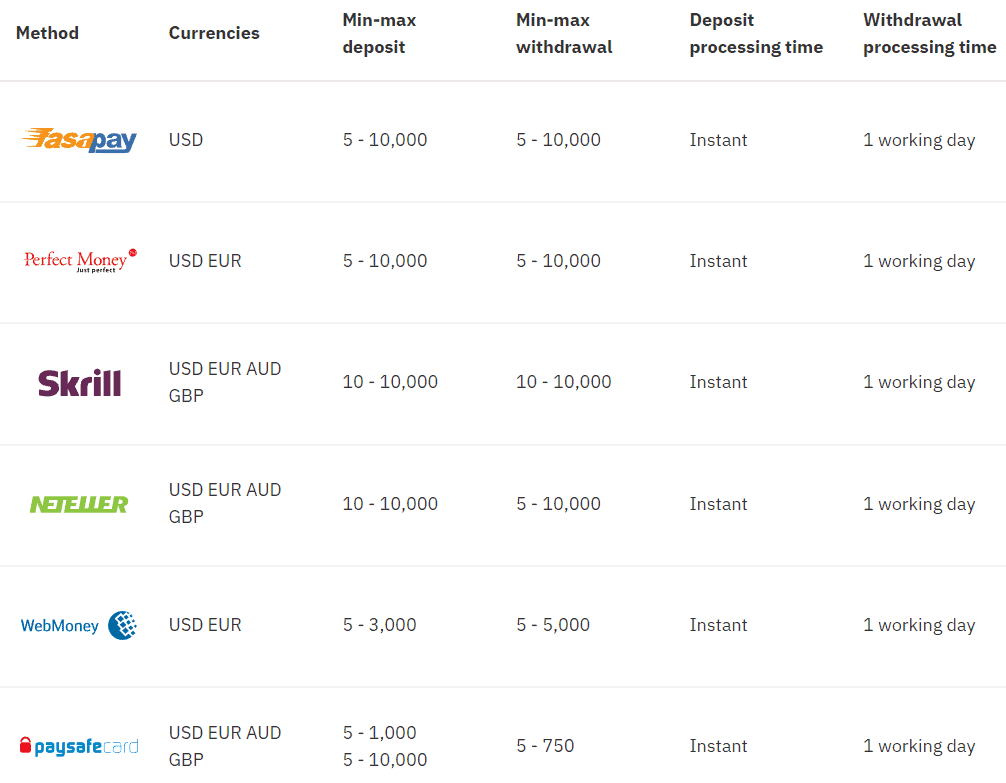

Deposit and withdrawal methods

Deposit

Deriv provides a variety of payment methods: credit/debit cards, bank transfers, e-wallets and cryptocurrencies. Your funding options should also be informed in your account's base currency to save on conversion costs. The exchange has no deposit bonuses.

- Bank transfer: The minimum deposit is 5$ and most deposits are processed instantly.

- Credit/debit card: Both Visa and Mastercard can be used with a minimum deposit of 10 USD/GBP/EUR/AUD. Credit and debit card deposits are processed instantly.

- E-Wallet: All the most popular e-wallets such as Skrill, Neteller, PaySafe, Fasapay and WebMoney are all accepted for payment at Deriv. These wallets all support instant deposits and require a minimum deposit of 5% to be able to deposit money into your account quickly.

- Cryptocurrencies: You can deposit your funds in Bitcoin, Ethereum, Litecoin and Tether. There is no minimum deposit when using cryptocurrency, payments are processed in three blockchain confirmations.

Withdrawal

You can withdraw funds from your Deriv.com account using all deposit payment options. Depending on the provider, bank withdrawals start from 5 of your base currency and are processed in 1-2 business days. Minimum debit/credit card withdrawals are 10 in your base currency and processed within one business day.

Not charging any fees for deposits/withdrawals makes Deriv one of the most accessible and cost-effective brokers for deposits and withdrawals.

Customer support

You can take advantage of the 24/7 customer support service through Live Chat, WhatsApp and the Help Center on Deriv. For customer support reasons, in addition to its headquarters in Malta, the broker also has other representative offices in other European countries such as the UK, France, Cyprus and Guernsey, as well as in Asia, the Middle East, Eastern Europe, Africa, Latin America, the Caribbean and Oceania.

| Pros | Cons |

| • Live Chat, phone number, WhatsApp and Help Center available • 24/7 support • Ability to provide support and answer questions well | • Support response time is quite slow |

Conclusions

Deriv's trading service is considered a trusted broker with many trading tools and professional trading platforms. The broker is authorized and regulated by many financial regulators, thus providing a high level of security and transparency. Commission-free trading, no deposit and withdrawal fees, and negative balance protection are the notable advantages of this broker. However, the conditions depend on the institution you deal with.

Generally, traders expressed satisfaction with Deriv's trading conditions and products. However, there have been reports of delays in customer support responses from some users. So overall, we recommend that you conduct thorough research before deciding to use Deriv to ensure that it suits your trading requirements.

Deriv offers complex derivatives, such as options and contracts for differences ("CFDs"). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.