IC Markets is the world's leading reputable foreign exchange exchange, founded in 2007 in Sydney, Australia by a group of experts in the financial industry. IC Markets is also the 2nd fastest growing exchange in the world behind XM and the world's leading retail broker and trading volume.

General information

IC Markets is a broker established in Australia in 2007 as a foreign exchange and cryptocurrency provider. Through a process of development, up to now, IC Markets has risen to become the second largest trading platform in the world, attracting many people to trust and participate. Every day, the number of transactions on this platform reaches 500,000. The total number of visitors and transaction volume as of February 2021 has reached 180,000 people, equivalent to 950 billion USD.

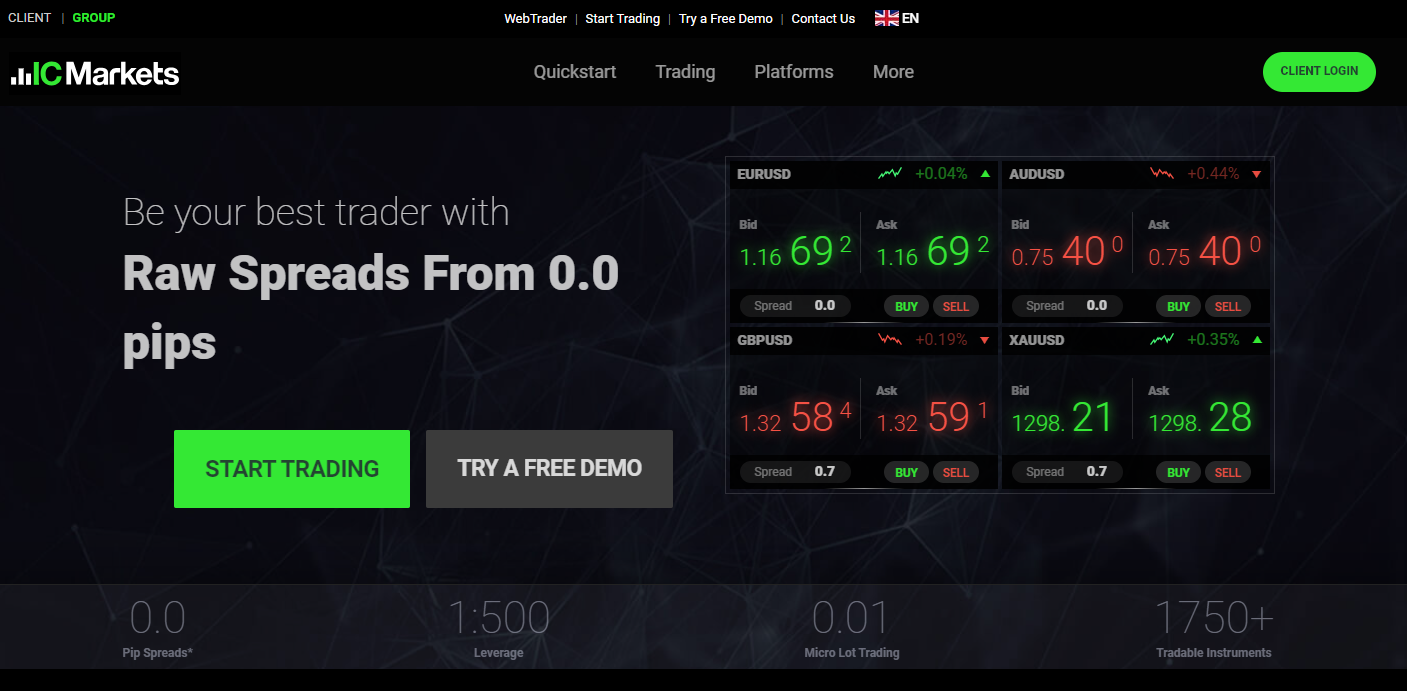

Besides, IC Markets also provides its customers with the best possible trading conditions. IC Markets is always constantly developing and innovating advanced technology. Always providing the lowest spreads, super-fast order matching speed and the best customer service...

| Name | IC Markets |

| Founded year | 2007 |

| Headquarters location | Sydney, Australia |

| Official website | https://icmarkets.com |

| Contacting methods | – Live Chat – Call phone number – Email support@icmarkets.com |

| Trading products | Forex, Commodities, Stock Indices, ETFs, CFDs, Cryptocurrencies |

| Trading tools | CFD, Forex |

| Minimum deposit | 200$ |

| Leverage | 1:500 |

| Trading platforms | MetaTrader 4, MetaTrader 5, cTrader, Web |

| Fees | Depends on account type |

Pros and cons

| Pros | Cons |

| • Diverse payment methods • Fast and user-friendly trading platform • Lowest spread in the market • Certified and monitored by leading organizations • Quick and dedicated customer care • Diverse trading products | • High minimum deposit amount, up to $200. • There are not many promotions. • The withdrawal process is complicated and takes a lot of time. |

Is IC Markets a scam?

No, IC Markets is not a scam. IC Markets is considered trustworthy as it is regulated by the leading ASIC in Australia.

Below is the full list of IC Markets regulators and its clients:

- Customers in the EEA, excluding Belgium, Switzerland, Latvia – Cyprus Securities and Exchange Commission (CySEC)

- All customers except Australians – Seychelles Financial Supervisory Authority (FSA)

- Australia – Australian Securities and Investments Commission (ASIC)

Licenses

IC Markets is licensed by the following authorities:

- ASIC (Australian Securities and Investments Commission) of Australia number ACN 648 014 215.

- UK FSA (Financial Services Authority) number SD018.

- CySEC (Cyprus Securities and Exchange Commission) of Cyprus No. 362/18.

- SCB (Securities Commission Bahamas) with License No. SIA-F214.

In addition, IC Markets is currently honored to be a member of the Australian Financial Complaints Authority (AFCA) - an accredited external dispute and complaint resolution agency operating with the Australian Government, aiming to Create fairness in disputes between customers and brokers.

Security methods

Separate bank account system

By complying with the requirements of the segregated account system, IC Markets must separate 2 account groups including:

- Group 1 – Bank account, e-wallet (to store customer deposits)

- Group 2 – Company current accounts

Such separation helps customers feel completely secure in their deposit amount.

At the same time, to ensure the safety of customer assets, IC Markets also conducts regular audits that are reported to traders annually. Not only that, to properly implement the Account Segregation Regulation, IC Markets uses account services of major banks in Australia such as Westpac Bank, National Australia Bank (NAB) to store deposits. to customers under ASIC regulation and Barclays Bank under FSA regulation.

Compensation up to 20,000 EUR if the exchange goes bankrupt

Another risk assurance program of IC Markets is the compensation of 20,000 EUR as committed on the CySEC license in case IC Markets goes bankrupt.

Customer insurance and policies to protect customers in the event of a dispute

In addition, IC Markets also purchased an insurance package from Lloyds London insurance company to provide maximum protection in case the exchange does not have enough compensation money as required by CySEC as above. At the same time, IC Markets is a member of the Australian Financial Complaints Authority to provide customers with a safe position and protection when disputes arise if they detect signs of fraud or deceit on the floor.

Types of trading accounts

Raw Spread Account

This account type is considered the most popular type of ICMarkets. This type of account is highly appreciated by the Trader community with super low transaction costs.

- Spreads are super low, on average just 0.1 pip for the EUR/USD currency pair.

- Commission fee is about $3.5 per lot per side.

- ICMarkets' Raw Spread account has super fast order execution times and almost no lag in it.

- There is a possibility of requoting an order for your Raw Spread account in IC Markets is extremely low.

Raw Spread (cTrader) Account

ICMarkets cTrader accounts have low commissions and spreads. This type of account is also suitable for scalping or intraday trading investors.

Up to now, MetaTrader 4 is still considered the most popular and easy-to-use platform. New investors should use MetaTrader 4 instead of cTrader.

Standard Account

ICMarkets' Standard account also operates on MetaTrader 4 and MetaTrader 5. Compared to Raw Spread, Standard has similar latency and execution speed. Standard accounts will have no commission fees. But in return, the spread fee of the Standard account is slightly higher than the Raw Spread account and cTrader account, an average of 1.0 pip for the EUR/USD currency pair.

| Characteristic | Raw Spread (cTrader) | Raw Spread | Standard |

| Minimum deposit | 200$ | 200$ | 200$ |

| Maximum leverage | 1:500 | 1:500 | 1:500 |

| Spreads | From 0.0 pip | From 0.0 pip | From 1.0 pip |

| Commission fees | 3$/lot | 3.5$/lot | Free |

| Minimum volume | 0.01 | 0.01 | 0.01 |

Leverage

Currently, IC Markets is supporting a leverage level of 1:500, which is considered a fairly low leverage level compared to other reputable exchanges such as FBS (leverage 1:3000), Exness (leverage 1: infinity), FXTM (leverage 1:1000),… However, high leverage is inherently a double-edged sword, so IC Markets providing moderate leverage helps ensure stable trading psychology and capital management safely and thereby avoid burning investor accounts.

Trading platforms

MetaTrader 4/MetaTrader 5

Similar to the MT4 and MT5 platforms like other exchanges, however, the platform provided by IC Markets has the following outstanding advantages:

- Easy to use

- Extremely low Spreads

- Extremely fast order matching, no delay

cTrader

cTrader is a trading platform from the UK company Spotware. This is software exclusively for use by ECN brokers. However, this is a rather picky platform for users compared to MT4/MT5, because the indicators have few functions and are not popular. Despite this, cTrader is still trusted by some traders because of the following features:

- Beautiful, eye-catching interface.

- There is no need to keep the machine on 24/7 when setting up a trailing stop like on MT4.

- Supports closing orders partially or completely.

- Specialized features such as VWAP or market depth measurement.

- Easily upload data to Myfxbook.

Trading products

ICMarkets forex broker offers the following products:

- Commodities: Including 19 diverse products such as agricultural products, energy, and metals. With precious metal products such as gold, silver or energy, you will enjoy maximum leverage of 1:500. For other products such as coffee, wheat, sugar, corn, and soybeans, this number will be 1:100.

- Cryptocurrencies: Includes 10 products and enjoys maximum leverage of 1:5.

- Forex currencies: Includes 65 currency pairs with maximum leverage of 1:500 and 1:20.

- Shares: Includes 120 products traded only on MT5, enjoying maximum leverage.

- Indexes: Includes 17 products, enjoy maximum leverage of 1:200.

- Bonds: Includes 6 products, enjoy maximum leverage of 1:200.

Fees

Commission fees

IC Markets operates as an ECN floor, so its commission fees are relatively high. Of the two account types, only the Standard account does not charge commissions, the remaining accounts have two-way commissions from $6/lot for Raw Spread (cTrader) accounts and $7/lot for Raw Spread accounts (MT4 and MT5).

Spread fees

The outstanding feature of IC Markets is that the spread fee is only 0.0 pip and an average of 0.5 pip for each currency pair. This is an extremely competitive spread in today's market.

Overnight fees

For foreign exchange currencies, IC Markets provides services with quite reasonable overnight fees, for example, USDTRY sell orders are -150 USD/lot and sell orders are +79 USD/lot. However, for cryptocurrencies, IC Markets charges quite high overnight fees, which will cost you 20USD/lot for both sell and buy orders.

Deposit and withdrawal methods

Deposit

At IC Markets Vietnam, a special feature is that investors are supported to deposit money via Paypal and more than 24 domestic banks via Internet Banking. It can be said that these are two extremely convenient charging channels for Vietnamese people.

In addition, investors should note that whichever port they deposit money into, they must withdraw money using that port. For example, if you deposit 400 USD into IC Markets using a Visa Credit credit card, then if you want to withdraw 400 USD, it will be withdrawn to that same card. At the same time, the interest from the deposit will be refunded through other portals such as Neteller and Paypal.

Withdrawal

IC Markets supports free withdrawals, however if investors withdraw via International Bank Wire (bank wire transfer), it will cost an additional 20 USD (ie 300,000 VND) because the bank collects this fee.

In addition, an inadequacy of IC Markets is that investors must withdraw money before 8:00 a.m. (Vietnam time) for the money to arrive at 3:00 p.m. that day. If it is after 8am, the money will be returned the next day.

Conclusions

IC Markets is a trading broker worth experiencing for Vietnamese traders with all its prestige, professionalism and quality. This is a suitable forex exchange with interesting features, diverse trading products, supports many deposit and withdrawal methods with many diverse trading platforms, and is one of the exchanges with low spreads. Super low, comfortable commission levels and dedicated, enthusiastic customer service.